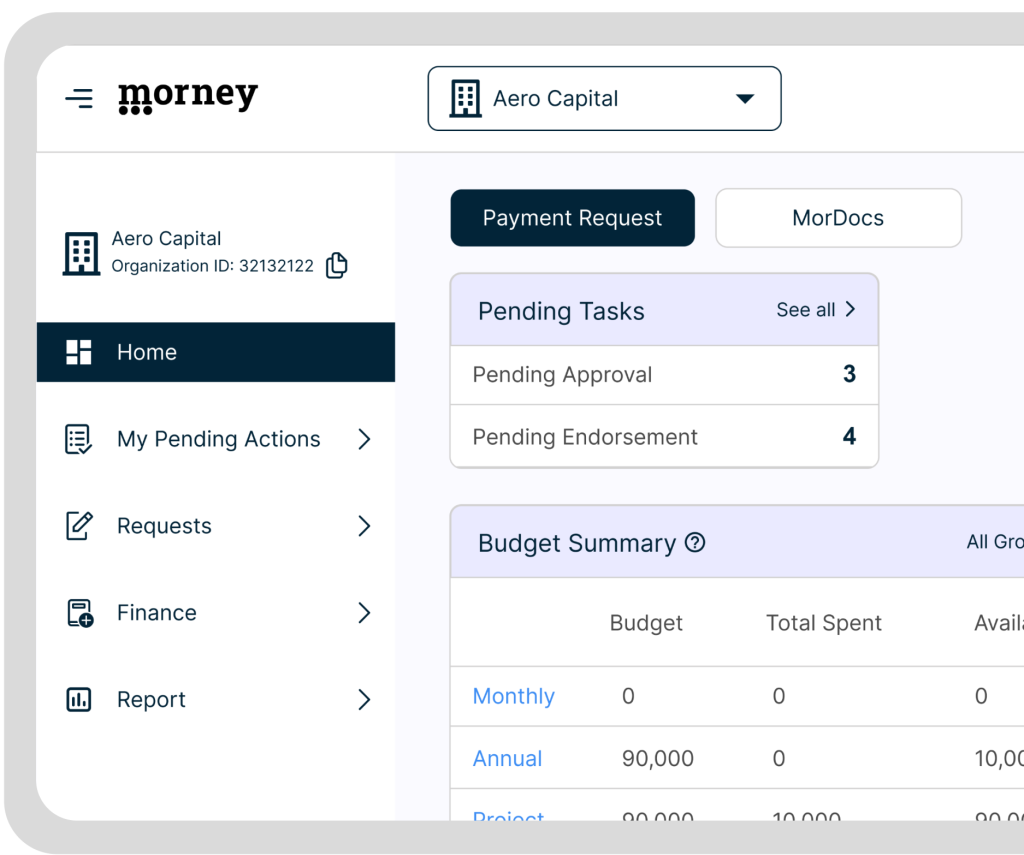

Scale business automation with Morney

Automate all requisitions, contracts, and disbursements in minutes, no scattered emails, no manual paperwork, and no code required. Just ease and certainty.

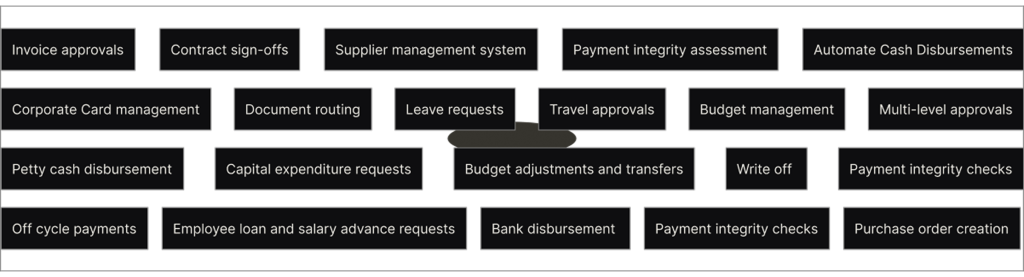

Your complete toolkit for Business process automation

Morney gives finance teams a single place to approve spending, validate requests, control budgets, and safeguard financial decisions. Every workflow is guided, documented, and fully traceable.

- Expense Reimbursement

- Travel request and per diem approvals

- Vendor invoice payment

- Corporate card management

Morney brings structure to the entire procurement cycle, from vendor onboarding to contract award and asset disposal. Every step follows a clear approval path and maintain documentation that is impossible to lose.

- Vendor onboarding and KYC

- Contract award and LPO approval

- RFQ creation and release

- Single vendor or sole justification

Daily operations becomes easier when every internal request is handled in one place, keeping processess moving without bottlenecks.

- Petty cash requests

- Fleet allocation

- Facility access requests

- Equipment service requests

Morney provides a reliable way to handle sensitive employee processess, managing onboarding, welfare, and policy documentation with accuracy and full records for audits.

- New hire requisitions

- Leave requests

- Employee loan requests

- Policy document sign-offs

Morney enables IT teams to manage users access, hardware handovers , and helpdesk tickets with controlled paths, while efficiently governing software procurement, infrastructure, and date permissions.

- User access creation

- Device handover docs

- Password reset requests

- Bug reports

Morney supports legal and regulatory reviews with clear documentation and version control, ensuring oversight through sign-offs, KYC checks and policy adherence.

- Vendor KYC checks

- NDA contract reviews

- Compliance checklist

- Vendor contract awards

Morney helps security teams formalize approval path for quick reviews of security cases, policy exceptions and continuity planning.

- Incident report

- Risk assessment forms

- Equipment documentation

- Software license requests

Morney provides leadership teams with a structured environment for corporate approvals and high level decisions, ensuring necessary speed, discretion and solid documentation.

- Contract approval

- Multi-level sign-offs

- Procurement sign-offs

- Invoice payments

- CUSTOMER STORIES

For large organizations and small family offices

Businesses and Non-Profits automate their processes with ease and see the ROI immediately.

I would absolutely recommend Morney to a colleague because it simplifies my work process by minimizing the stress of seeking approval via email. I also receive real-time notifications on every part of the payment processes.

- Operations Analyst at Facility Management Company

Morney has been a game-changer for us. We’ve not only improved our vendor relationships but also streamlined our operations and reduced project delays. Morney is now an indispensable partner in our growth journey.

- CEO, Leading Facility Management Company

I would absolutely recommend Morney to a colleague because it simplifies my work process by minimizing the stress of seeking approval via email. I also receive real-time notifications on every part of the payment processes.

- Operations Analyst at Facility Management Company

Digitize and automate mission-critical processes like onboarding, leave requests, and memo sign-offs. Use MorDocs for document routing and MorSign for e-signatures, both fully integrated with Morney. Every record stays traceable, secure, and compliant from review to signature to payout.

- Head of IT, Microfinance Bank

The company loves Morney because it has made payment voucher processing more seamless.

- Finance Manager, Pensions Company

No hype. Just results

Get started in 15 minutes

Average ERP deployment period is >18 months - Gartner.

10hrs +

Average hours of work freed up per week per employee.

Get started for a cost of a team lunch.

Organizations use 3-5% of your revenue to implement ERP Solutions - Forbes.

80%+

Manual work automated

Morney gives you the flexibility of emails and the benefits of process automation.

Deploy a complete, end-to-end approval system in days, not months.

Get a single source of truth for all Finance, HR, Legal, Admin, and Procurement decisions.

Enforce complex governance and spending policies without writing a single line of code.

Empower managers to approve instantly, anytime, anywhere

Explore Morney’s business automation tools

Unparalleled insights for your managers

The core value-add goes beyond the business logic of moving documents digitally. It lies in the insights and analysis we provide to managers, empowering teams with unparalleled visibility, automating checks, and helping organizations focus on the issues that truly matter.

Close your month without chasing paper

Automate all pre-accounting checks, payment requests, invoices, disbursements, and spend-limit controls. Morney’s Payment Integrity Engine continuously analyzes transaction data, verifies payees, and detects duplicates. Every request, attachment, and approval stays accurate, compliant, and ready before money moves.

Remove friction, keep deals moving

Turn scattered approvals into traceable, rule-based workflows. Centralize all requisitions, reviews, and digital signatures for POs and documents. Automate policy enforcement and compliance checks within the workflow. Keep operations fast, controlled, and fully auditable.

From approved to signed in one workflow

Digitize and automate mission-critical processes like onboarding, leave requests, and memo sign-offs. Use MorDocs for document routing and MorSign for e-signatures, both fully integrated with Morney. Every record stays traceable, secure, and compliant from review to signature to payout.

- Start automating

Go from busywork to reliable control in one decision

Secure

Transparent

Audit Ready

Create offboarding checklist

Onboard a vendor

Sign a contract

Publish a memo

Unparalleled insights for your managers

The core value-add goes beyond the business logic of moving documents digitally. It lies in the insights and analysis we provide to managers, empowering teams with unparalleled visibility, automating checks, and helping organizations focus on the issues that truly matter.

Close your month without chasing paper

Automate all pre-accounting checks, payment requests, invoices, disbursements, and spend-limit controls. Morney’s Payment Integrity Engine continuously analyzes transaction data, verifies payees, and detects duplicates. Every request, attachment, and approval stays accurate, compliant, and ready before money moves.

Remove friction, keep deals moving

Turn scattered approvals into traceable, rule-based workflows. Centralize all requisitions, reviews, and digital signatures for POs and documents. Automate policy enforcement and compliance checks within the workflow. Keep operations fast, controlled, and fully auditable.

From approved to signed in one workflow

Digitize and automate mission-critical processes like onboarding, leave requests, and memo sign-offs. Use MorDocs for document routing and MorSign for e-signatures, both fully integrated with Morney. Every record stays traceable, secure, and compliant from review to signature to payout.

- Start automating

Go from busywork to reliable control in one decision

Secure

Transparent

Audit Ready

Create offboarding checklist

Onboard a vendor

Sign a contract

Publish a memo

- approval + automation

Get things done

Morney brings all your approval and workflow processes into one connected space. From payments and purchase requests to contracts, leave, and document sign-offs, everything moves faster, stays organized, and gets done without the daily back-and-forth.

Design smarter workflows

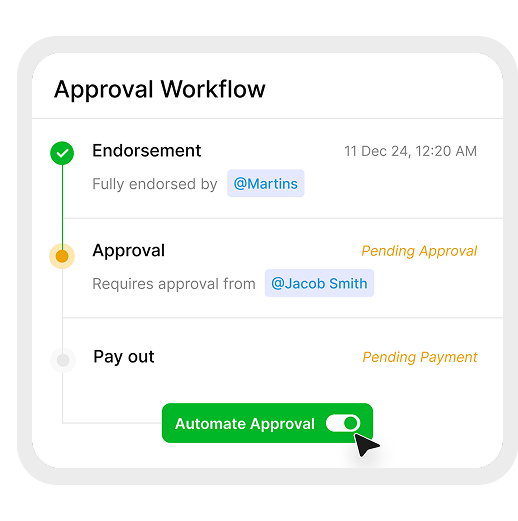

Build and automate approvals in minutes

Morney Workflows make it easy for teams to design custom approval steps, set routing rules, and keep everyone aligned. Simple to set up, powerful enough for IT to scale.

Keep documents moving

MorDocs helps you create, share, and track every document in your process. No missing attachments or lost versions.

Sign and approve instantly

MorSign lets you sign and confirm approvals securely from anywhere, keeping your business in motion.

Connect everything you already use

Morney integrates with your accounting and banking apps so your data stays in sync and your team stays aligned.

Move faster. Work smarter.

Finance, operations, and HR teams can now build what they need across departments while IT maintains full visibility and control. Morney gives your business the power of automation with the clarity and control you need to keep things running smoothly.

Built for growing teams

Smart roles and permissions

Set approval rights and limits that match how your team actually works.

Clear audit history

Every action, comment, and signature is recorded so nothing gets lost in the shuffle.

Automatic policy and budget checks

Stay on top of spending with built-in controls that flag issues before they become problems.

Made for real work

Morney helps you cut out the manual steps, connect your tools, and keep your business running at full speed.

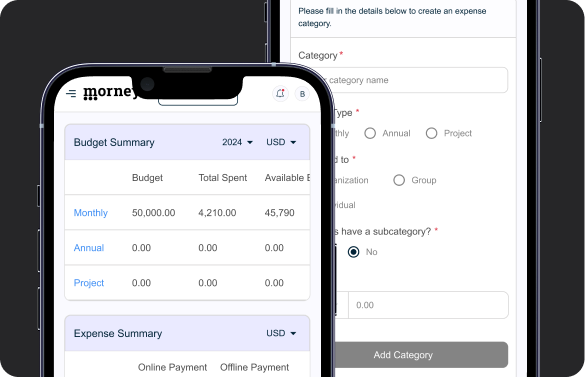

Access anywhere

Approve, track, and sign from your phone or laptop with the same simple experience.

Instant insights

See where requests stand, spot bottlenecks, and track performance with easy reports and dashboards.

Investment Maturity Payment

| Without Morney | With Morney |

|---|---|

Finance Officer logs into the bank portal. Finance Officer logs into the bank portal. Finance Manager reviews manually. Finance Manager reviews manually. Executive Member signs off. Executive Member signs off. Attachment missing, email sent. Attachment missing, email sent. No response after 2 days, another email sent. No response after 2 days, another email sent. Correction needed. Correction needed. Days pass while everyone waits. Days pass while everyone waits. Reconciliation turns into guesswork. Reconciliation turns into guesswork. No one is fully sure what cleared — or when. No one is fully sure what cleared — or when. |

Employee submits request, workflow triggered. Employee submits request, workflow triggered. Finance processes via integrated gateway. Finance processes via integrated gateway. Morney confirms and records transaction. Morney confirms and records transaction. |

| Slow, confusing, and full of blind spots. | The entire process — complete, traceable, and done in minutes. |

Supplier Invoice Submission

| Without Morney | With Morney |

|---|---|

Supplier emails an invoice. Supplier emails an invoice. Someone downloads it.

Someone else prints it. Someone downloads it.

Someone else prints it.

It lands on the wrong desk

. It lands on the wrong desk

. Finance finally gets it… without the purchase order. Finance finally gets it… without the purchase order.

They call Procurement. They call Procurement. Procurement calls Operations. Procurement calls Operations.

Supplier calls everyone. Supplier calls everyone.

Everyone’s buried in threads. Everyone’s buried in threads.

Nobody knows where the invoice is. Nobody knows where the invoice is. |

Supplier self-onboards, uploads KYC docs. Supplier self-onboards, uploads KYC docs.

Submits invoices for approval. Submits invoices for approval.

Finance sees everything. Finance sees everything. |

| Slow, confusing, and full of blind spots. | The entire process — complete, traceable, and done in minutes. |

- SAFE & SECURE

Security you can trust

Morney keeps every approval and payment secure. Whether it’s invoices, contracts, or disbursements, your team stays in control and your data stays protected. That’s why finance, operations, and business teams trust Morney to keep their workflows safe, accurate, and reliable.

Security that works quietly in the background

Morney gives you complete confidence that every workflow, document, and transaction is safe and traceable.

SOC 2 & SOC 3 Compliance

Meet strict security standards and protect your business data with confidence.

GDPR & PIPEDA Compliance

Your information stays private, secure, and always under your control.

Peace of Mind Built In

Every workflow stays protected, every record stays clear, and every action stays accountable.

End-to-End Audit Trails

Track every approval, signature, and change with real-time logs and alerts.

Error Handling and Recovery

Morney identifies and resolves issues before they interrupt your work.

Dependable Uptime

Your approvals and payments keep running smoothly with guaranteed reliability.

Ready to protect your business workflows?

Join the growing businesses that trust Morney to keep their approvals clean, compliant, and always moving.